Support research – assignment of 2% of your tax

Even the 2% of your income tax can help science and research in Slovakia

The driver and incentive for those who assign their 2% every year is to contribute to activities that actually make real sense. In MGA, we believe that it makes a difference to focus on biomedical science and research in Slovakia. Slovakia has competent scientists and researchers with outstanding innovative skills and who can readily apply the results of science and research in practice.

We invest the acquired funds from the 2% tax assignment to MGA in new instrumentation for our research laboratories, in the expansion of the lab infrastructure and to co-fund scientific research projects which are designed to develop more sensitive examination methods.

How does MGA use the assigned 2% tax?

In Slovakia, the government support of science and research is rather limited. Using also the 2% tax assignment, we are constantly trying to push the envelope in science and research, which brings benefits in the form of new, more efficient and more sensitive tests in a wide range of specialties. Also, we work hard to innovate diagnostic methods in laboratory diagnostics. In the following months and years, we wish to focus our research activity primarily on the diagnosis of cancer and lifestyle diseases using non-invasive methods. We are also working to develop a system for early and rapid detection and diagnosis of new infectious diseases with pandemic potential – specifically COVID-19.

Many non-profit organizations can help others exactly thanks to the 2% income tax assignment. Employees who have been paid a salary by their employer have the possibility to assign a part of their due income tax each year until the end of April. If they do not assign the 2% of their income tax, the amount will be credited to the state budget. According to the statistics from the Ministry of Finance, each year an increasing number of individuals and organization assign the 2% of their due income tax. It can make a difference, if they donate this amount to organizations that help change the world to be a better place.

How does the 2% tax assignment system work?

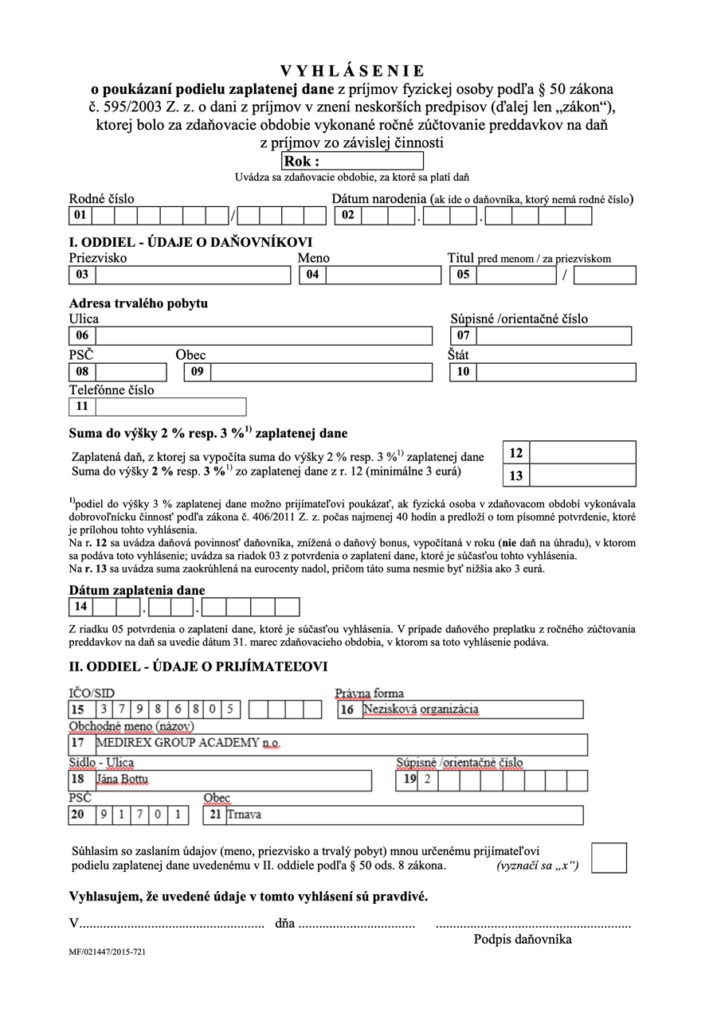

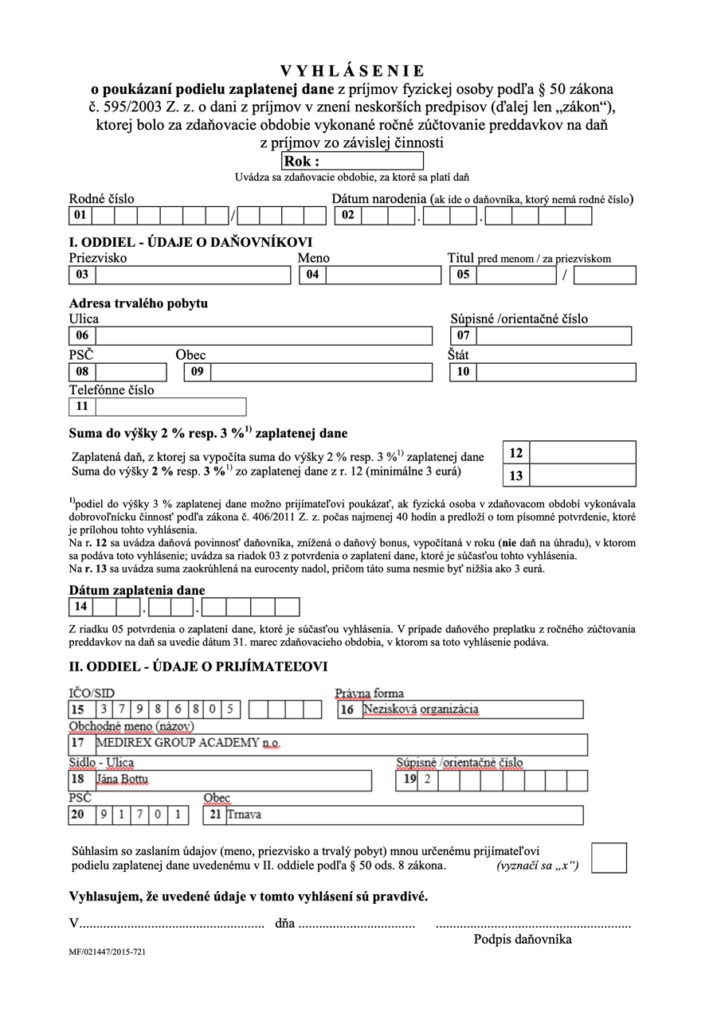

- Each employee may request his employer to perform an annual settlement of income tax advances and to issue a confirmation of income tax payment.

- Subsequently, the employee completes the declaration of assignment of 2% from his/her income tax. They shall state their name, birth ID number, address, the amount corresponding to 2% of the income tax paid and the organization to which they wish to assign the 2% of the tax.

In the case of MGA:Legal form: Legal form

ID/SID: 37 986 805

Business name: MEDIREX GROUP ACADEMY n. o.

Registered office: Jána Bottu

Street number: 2

Postal code: 917 01

Municipality: Trnava

- The employee sends the completed form by 30th April to the Tax Authority in the place of the employee’s permanent residence address.

Good to know...

What is more, some employees may even assign 3% of the tax paid instead of only 2%. These are the employees who volunteered for at least 40 hours last year and provide written confirmation of such activity. This document is then attached to the tax assignment declaration. However, take note that should you make a mistake when completing the declaration, the employee will be asked to correct the error. In case you fail to do so, the 2% will not be assigned and disbursed to the organization. The same applies if the declaration contains incorrect information about the beneficiary of tax assignment. The right to assign the share of the tax paid thus automatically expires.